Reading time: 1 minute (plus instagram posts)

Since late last year, Carmelle, one of young professionals, has been helping and inspiring many of us to be better with our finances. Through her Instagram page, Centsability, she unpacks all things personal finance. As a Compliance Manager, she has a lot of knowledge to share. This passion project began with a desire to merge her interest in personal finance with small doses of virtue.

With Tax time just around the corner, we’ve decided to pull together her top tax time posts that may help you with your tax return. We’ve also included a few bonus COVID-19 inspired posts that may help you ride out the last few months of restrictions too.

Please scroll down and click the little “+” button to read her posts.

What is personal finance?

What's the end game?

centsability_ “Live like no one else so you can give like no one else.” This quote from @daveramsey is everywhere but I love it. Money, in its proper place, is simply a means to an end. What is the end? To serve others.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Personal finance isn’t about becoming rich in order to show off or hoard money out of greed. It’s about making sound, sensible financial decisions that can provide security for you and your family. It’s about knowing how financial structures work in the world so you know how to play the game.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

It’s about being in a position that allows you to be generous towards charities and causes close to your heart.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Money doesn’t bring happiness, but it can remove financial insecurity as a source of anxiety, and it can give you freedom to move and make choices.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Personal finance is about exercising prudence, discipline, wisdom and self-sacrifice – virtues that will strengthen our overall character and benefit us holistically. It’s also about passing on those virtues to the next generation and leading by example.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

“Blessed are the poor, for theirs is the kingdom of heaven.” Poverty can be a refining fire for our soul: it strips the unnecessary and forces us to focus on the essential. For those living in genuine poverty, they will be blessed in other ways. For the rest of us, we can still live out the virtue of poverty by exercising detachment to material goods and being generous to others.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

If you have an abundance of money but do not have the virtues and skills to handle it properly, money will corrupt your heart. It will inflate your pride & ego, it will result in frivolous and unwise decisions, it will slowly consume you, often at the expense of others. Too much money will expose you for who you really are, all your flaws, insecurities, wounds and inclinations towards selfishness or vanity. And eventually, money will no longer be a means to an end but the end itself.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

This is my personal challenge, to talk about money and finances in a healthy way, but not get consumed by it. To always see the end game: serving the other.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

{Rambling, incoherent personal reflection on money}

—–

To make a tax-deductible donation to help the mission and vision of Lowana please click here.

Top Tax-time Tips

How do tax deductions work?

centsability_ Some people think that “claiming things on tax” means you’ll get 100% of the cost back. I wish! 😃

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Here’s how tax deductions work:

⠀⠀⠀⠀⠀⠀⠀⠀⠀

1. Your “taxable income” is the amount of income you earn which will be taxed at a certain %

2. You can LOWER your taxable income (and thereby lower the amount of tax you pay) by claiming tax deductions

3. This is particularly helpful when tax deductions bring your income into a lower income tax bracket.

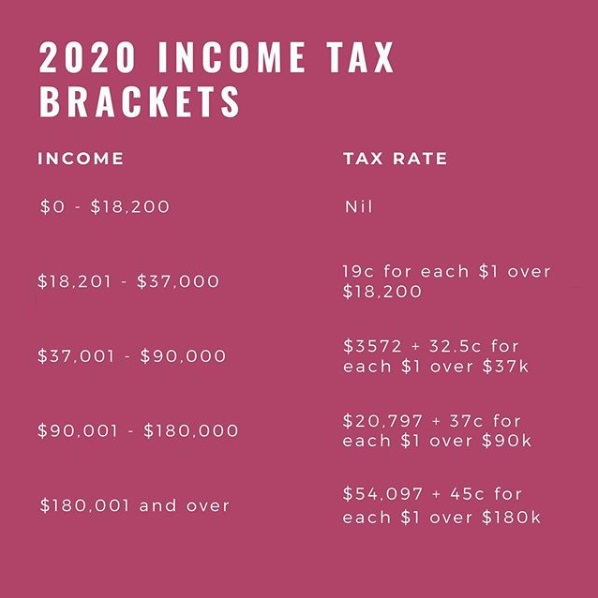

4. Income tax brackets are the ranges of income that correspond to a certain tax rate (i.e. the percentage you are being taxed). The lower the bracket, the lower the tax rate. (Swipe to see Aussie income tax brackets)

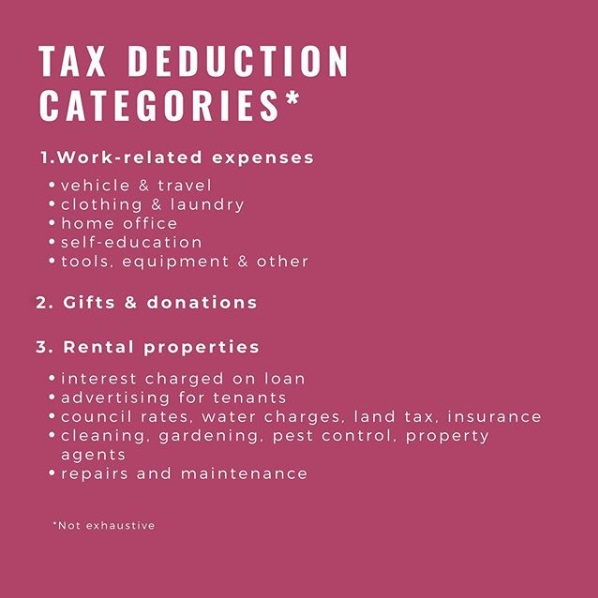

5. Categories of tax-deductible expenses include: work-related expenses, investment property expenses and charitable donations

⠀⠀⠀⠀⠀⠀⠀⠀⠀

EXAMPLE: Ana’s gross income is $40k. She claims the following expenses: $1500 work equipment; $2000 in interest charged for her investment property; $500 charitable donations.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Her taxable income is gross income minus deductions: $40k – ($1500 + $2000 + $500) = $36k.

(For simplicity, I have omitted the various levies & rebates)

⠀⠀⠀⠀⠀⠀⠀⠀⠀

She will need to pay tax on $36k, which is $3,382 (refer to tax brackets)

⠀⠀⠀⠀⠀⠀⠀⠀⠀

If she DIDN’T claim deductions, she would need to pay tax on $40k, which is $4,727

⠀⠀⠀⠀⠀⠀⠀⠀⠀

With her tax deductions, she was able to save $1345 in tax and lowered her tax rate from 32.5% to 19% by going down a tax bracket.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

MORAL OF THE STORY: Knowing how to make tax work to your advantage is a great tool that can save you lots of money. For property investors, this is a huge life saver. So claim those deductions! ☺️

——

To make a tax-deductible donation to help the mission and vision of Lowana please click here.

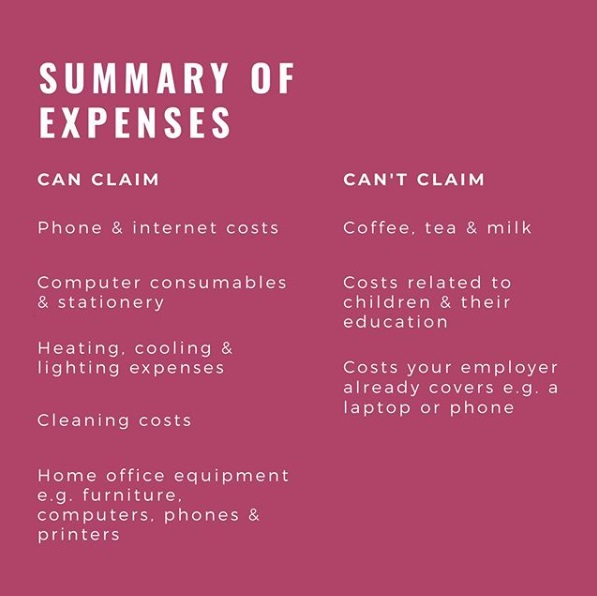

Working from home tax deductions

centsability_ Are you working from home like me? Did you know you could claim a bunch of working from home expenses? Here’s a summary of expenses that are all tax deductible:

⠀⠀⠀⠀⠀⠀⠀⠀⠀

☑️ Phone and internet expenses

☑️ Computer consumables (e.g. paper and ink) and stationery

☑️ Expenses arising from heating, cooling and lighting your work area

☑️ Cleaning costs for your work area

☑️ Home office equipment, such as furniture, furnishings, computers, monitors, phones and printers*

⠀⠀⠀⠀⠀⠀⠀⠀⠀

*Regarding home office equipment/furniture:

▫️For each item up to $300, you can claim the full cost

▫️For items over $300, you can claim the decline in value (there is a ‘depreciation and capital allowances tool’ in MyTax that can calculate this)

⠀⠀⠀⠀⠀⠀⠀⠀⠀

But let’s not be greedy now, there are some expenses you can’t claim 😋

✖️ Coffee, tea, milk and other general household items (I wish I could claim green tea expenses)

✖️ Costs related to children and their education e.g. online learning, equipment such as iPads and desks

✖️Costs that your employer already covers e.g. a laptop or phone

⠀⠀⠀⠀⠀⠀⠀⠀⠀

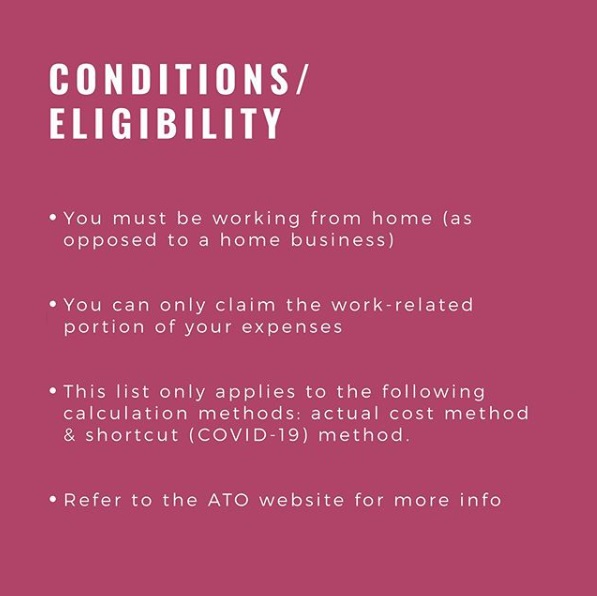

Of course, there are conditions and eligibility requirements to claiming these expenses:

☑️ you must be working from home as opposed to having a home business

☑️ you can only claim the work-related portion of your expenses (e.g. if you use your personal phone 10% of the time for work purposes, you can only claim 10% of your total phone expenses)

☑️ the above list of claimable expenses are only applicable to certain types of calculation methods (actual cost method & shortcut method for COVID-19).

⠀⠀⠀⠀⠀⠀⠀⠀⠀

It’s good to know what you’re entitled to claim especially if you’re forced to incur these expenses due to the virus. The virus has hurt us enough, so use the tax deductions to soften the blow 🤗 (See my other post on how tax deductibility works).

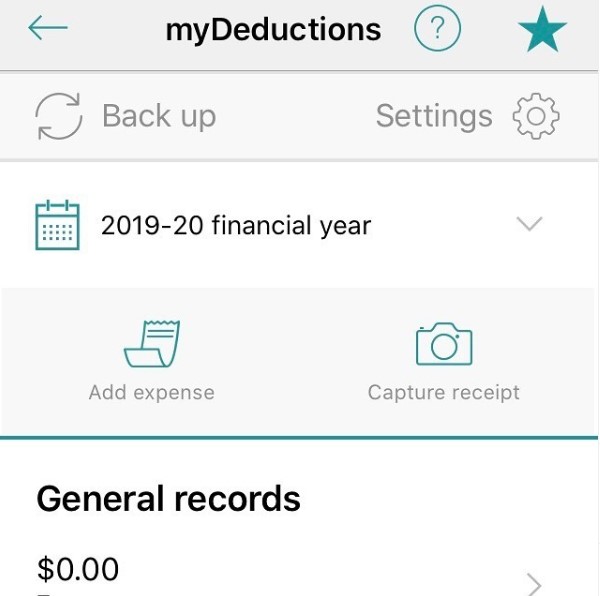

The ATO's MyDeductions App

centsability_ I’m a bit late to the game, but I only just discovered the ATO’s MyDeductions app. It helps you organise your tax deductible expenses by tracking:

▫️ expenses and deductions

▫️ vehicle trips if you drive for work

▫️ photos of your invoices and receipts

▫️ income (if you’re a sole trader)

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Come tax time, you can then email your data to your tax agent or link it to your tax return which will populate the relevant fields. I haven’t used it yet so I can’t rate it but so far it seems intuitive and easy to use.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

I have complicated tax deductions due to my investment property and shares, so I’m not sure how helpful it will be. I’ll probably have two trackers: my usual Excel spreadsheet for complicated deductions and the MyDeductions app for simpler expenses that I might otherwise forget to include in my spreadsheet.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

If you use MyDeductions, let me know if you like it and if it’s worth committing to 🤔

——

To make a tax-deductible donation to help the mission and vision of Lowana please click here.

COVID-19 Thoughts

Setting up my home office

centsability_ Isolation goal no. 1 done ✅

⠀⠀⠀⠀⠀⠀⠀⠀⠀

I set up my little home office on Sunday night (swipe left). I took home my double monitors, docking station, keyboard, etc from work, bought a dual monitor stand from Officeworks (will claim on tax), and then set it all up with my pink tool kit from ALDI! I knew that would come in handy one day!

⠀⠀⠀⠀⠀⠀⠀⠀⠀

My bro-in-law helped me out with the set up because I couldn’t loosen one of the screws lol #weak

⠀⠀⠀⠀⠀⠀⠀⠀⠀

It’s already made such a difference to my work efficiency. Previously, I was just on my laptop on my dining table and I just couldn’t get things done.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

I really wanted to improve my productivity and professionalism during this period to avoid/reduce any chances of redundancy. Deloitte, a big consulting firm, recommended this to staff recently too, as they looked at ways to keep everyone in jobs. If I can continue to produce good work and demonstrate my irreplaceability, I’m hoping to be in good stead if my company needs to make some cuts 🤞👩🏻🏫

Little Victories

centsability_ Week 6 of working from home and it’s getting harder to stay motivated amidst the drudgery and mundanity. Work ebbs and flows, but overall it has quietened down. I’m in this cycle of getting into a routine, blowing my routine, getting lazy, then slapping myself metaphorically and forcing myself to get back into a better routine.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

🌼 This morning was one of the good mornings:

✅ I woke up early

✅ I went for a jog with my dog 🦮🏃🏻♀️

✅ I was able to jog continuously for longer than previous runs

✅ I took a shower and got out of my pyjamas (yes that’s a win LOL)

✅ Did my morning prayer

⠀⠀⠀⠀⠀⠀⠀⠀⠀

I’ve been feeling so lazy and foggy in the mornings but I felt so much better after that run! My mind has been so preoccupied with random thoughts & anxieties and I really needed to clear my mind before I started work.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

So this is a little non-finance victory for me ☺️☺️ Hopefully I can replicate it the rest of the week!

My deal with Dom

centsability_ Dreaming about my future honeymoon in a post-COVID world 🌴

⠀⠀⠀⠀⠀⠀⠀⠀⠀

I made a deal with Dom: give me the wedding I want, and we can go wherever you want for our honeymoon 😁

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Initially, we thought maybe South East Asia because it would be fun, cheap and I’d get to sip cocktails 🍹 by the pool at a nice but inexpensive beachfront hotel.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Now Dom’s leaning towards Europe because he slightly freaked out when I told him we won’t be able to go on any big overseas holidays for a while if we have kids, and now he wants to tick everything off his bucket list 🤣🤣 Europe is amazing but hella expensive compared to Asia 😱

⠀⠀⠀⠀⠀⠀⠀⠀⠀

So we have to decide between: a fun but cheap trip vs an expensive one that ticks off a lot of bucket list goals before kids come into the picture.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

As long as we save and budget for it, I’m comfortable. And hopefully it’s safe to travel by then 🤞 Let me know if you have any honeymoon tips or even regrets!

📷: from my Philippines trip

Upskilling during lockdown

centsability_ I’m going a bit stir crazy so I might as well upskill during this lockdown! I work in the real estate/financial services industry and I’ve identified corporate finance as the biggest gap in my knowledge so far.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Thankfully, work recently granted approval for me to study a 12-week course on corporate finance (in addition to full-time hours), which will be paid for by my company.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

I also enrolled in a random free basic corporate finance course online to get a head start lol!

⠀⠀⠀⠀⠀⠀⠀⠀⠀

I have more time up my sleeve during this lockdown so I thought I might as well use it to study. A better understanding of corporate finance will not only benefit me professionally, but I’m sure there are financial principles that I can apply to my personal life too. I will try to share any interesting concepts I come across. I’m excited (I like studying) 👩🏻🏫

For more posts please visit the Centsability instagram.

———-

To make a tax-deductible donation to help the mission and vision of Lowana please click here.

How can I help?

Lowana continues to be a source of solace and hope to many of us and the community, but we need your help.

We understand many people are struggling financially, and this would not usually be a time to ask for a gift.

However, if you are in a position to help, please consider a making a tax-deductible gift of $50. Your gift will go towards helping the community through building a bigger and better Lowana.

Tax time is just around the corner, so take the opportunity to donate today by clicking the button below: